unlocking new digital banking capabilities with apis

With the swift move to the digital age, every business nowadays is becoming more digitized and every digital ecosystem is empowered by building application interfaces better known as APIs. Introducing APIs in the banking world would not only give both customers and businesses access to the transaction data in real-time, but also accurate and up to date information in terms of finances. Based on the revised regulations from the Payment Services Directive (PSD) like psd2, the creation of open banking environments is encouraged. Integrating payment APIs (psip) overcomes the inefficiencies in the transactional costs of intermediaries for the online payment industry.

How did API evolve into the pillars of open banking?

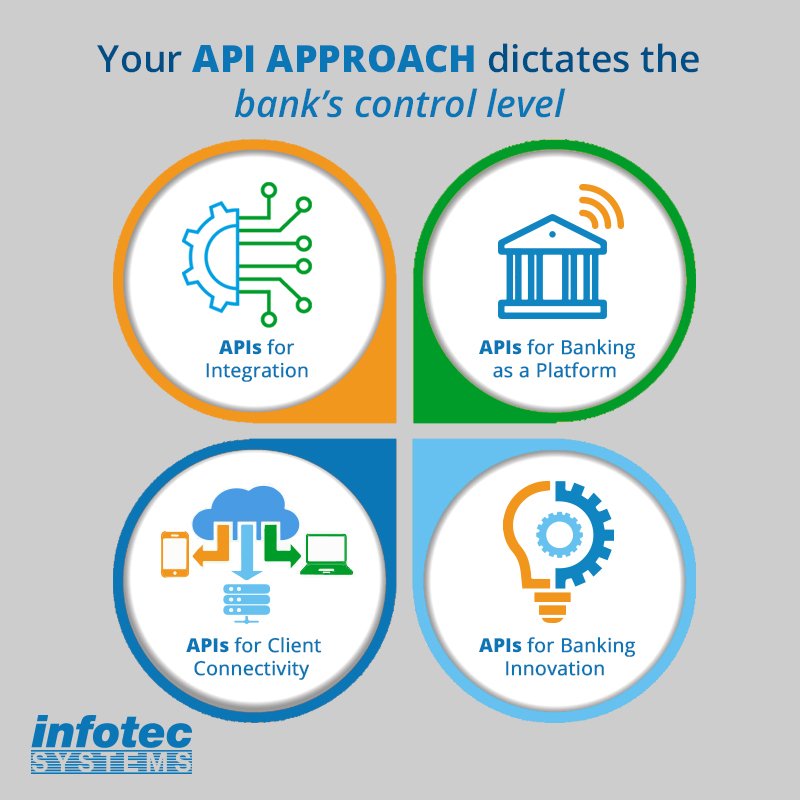

With new regulatory control over APIs they have become a critical technology allowing more interoperability between TPP and banks, including application integration, banking as a platform, innovation and client connectivity.

How does this translate into value for banks?

APIs can modernize your legacy-based silos by adding an extra integration layer, which enables the bank to uphold new digital capabilities by hooking APIs to real-tie, cloud-based, mobile, and financial tools applications’ APIs.

In order to unlock the business values of APIs four innovative approaches are to be followed:

- Building APIs for client connectivity

- Enabling the process straight through

- Moving to real time information flow

- Modernizing corporate to bank data

Using open banking APIs provides an ideal financial ecosystem for conducting business. Everything remains interconnected in terms of the need to grow and the availability of a solution. When a bank develops its own APIs it is now possible to link them to other APIs in no time and so the system grows rapidly with new and exciting features on the run.

Consent Management

As open banking grows, banks will find it hard to comply under new regulatory imperatives; APIs connect TPPs and banks on a fruitful collaboration, but pulling the balance on adequate data access and control levels over transaction data-on-demand can be a triggering action to a pitfall.

Overall the heart of this legislation is to allow the TPP’s controlled and regulated access to bank’s customers’ transaction data services and account information.

For banks to ensure the proper consent management, appropriate security and permission patterns should be identified for each integral party. For this to effectively take place and for banks to remain customer-centric, banks should ensure the parties have their customer’s consent on exchanging data.

Suggested methods & technologies to leverage for proper protection of customer data:

- Provide hardware and software compatible identity verification solution such as biometric or sound verification, or digital passport integration.

- TPP permission should be pre-registered during customer KYC and recorder in the bank’s “safe data vault”.

- Define whether a permission is one-use or several uses, and define the time period until permission expires.

APIs are a channel for all kinds of business strategies:

- Experienced APIs will be owned by the channel teams

- Process APIs by the business owner themselves

- System Apis should be controlled by application owners

Another approach would be through creating prioritized use case by case frameworks referred to as regulatory APIs which controls all operations.

Infotec Drilling for your next API integration

Many banks in the MENA have for some time been using elements of digitization, which we define as a layered approach towards unlocking new strategic business value from data-based technologies that include IoT, cloud-computing, artificial intelligence, machine learning, and real-time analytics. The most notable of these integration is NBB’s holistic approach to digitization which involved standardized APIs integration with MENA region’s first open banking platform, Tarabut.

Infotec advises on a cross-functional approach that balances new technology integrations with bank’s business capabilities.

Principle guidelines to engineering a successful API transformation:

- Always drive change with customer centricity on top-of-mind. Defining your audience’s trigger points and discovering how to consolidate their needs, requires a business-first approach, where the question is, how can digital technology mitigate the greater business challenges?

- Leading a successful API integration requires a holistic approach on your operating model, defining integration challenges on vision strategy, process, culture, and IT infrastructure can help you reconfigure your modules and leverage new digital-banking capabilities across your entire value chain; upstream or downstream.

- Building a digital organization needs to encompass players beyond the company itself if the full potential of the client operations is to be unlocked. All stakeholders around new API enabled and digitized bank — including the host and the payment service providers, payment processor, and receiving end consumer — need to be digitally enabled. For example, with mobile penetration exceeding 70% of the MENA, and with API enabling swift and secure mobile wallet deployment, areeba introduced Zaky, a top-rated user mobile wallet that enables seamless and secure payments.

- There is no one successful digital transformation strategy to follow. Each bank or financial institution needs to develop its own specific digital transformation road map. No matter the game plan, banks need the right partner to raise their business capabilities and ensure their transformation journey is met with innovative payment solutions and flexibility at every stage of the way.

As discussed throughout the article, many banks are demonstrating business value through integrating APIs. For banks just starting their API journey, get in touch with us!