Seamless banking, contactless payments, frictionless payments, these are all transaction-related terms that surged in our culture of convenience and fast services. Throughout the last year, contactless payments grew exponentially as Covid-19 accelerated its spread through surfaces and objects’ exchange. In the MENA alone, 2020 witnessed a 200% increase in contactless payments usage, on a global scale, MasterCard global consumer study on contactless payments concluded that 79% of the world banked population have now used contactless payments, and 46% had already migrated to contactless payments by getting rid of their old contact-based payment cards; but what’s with all the numbers? Contactless payments are overtaking the banking sector by storm, and as it all seems too interesting to dive into, but we must first understand the forces governing contactless payments and what comes in store next in terms of innovation in contactless payments.

To open doors towards greater discussion on contactless payments, and unlock new potential in seamless banking, we ought to SWIPE through some of the added-value that contactless payment brought up for banks, merchants, and the entire value chain of the payments industry.

Contactless payments are value for issuers, acquirers, consumers, and merchants alike:

- Transaction based revenue for issuers and acquirers

- Fx based revenue from multi-currency payment cards.

- Data analytics for merchants and loyalty-based management

- Faster check-out and higher transaction security for consumers.

- Practical and faster payments method for consumers, offering higher rewards.

- Mitigate risk of counterfeit usage of cards or phishing schemes.

- Keeping everyone safe from cross-contamination arising from cash flow.

Contactless had been more than a card swipe, or a boring bracelet that serves no other function, and could be stolen at a glance; contactless payments are expanding into more versatile and sophisticated means, such as crypto-based payments and loyalty-based digital cash as well as cross-border mobile wallets for low value and high value payments.

What comes next for Contactless Payments?

As a trusted and secure payments solutions provider, we believe the next big era of change would come from enabling greater interoperability for mobile wallets, which can be useful to access and exchange payments-related data, all while keeping the payment processing function trusted and secure. Mobile wallets can offer greater personalization and multi-channel usage if complimented with a physically issued contactless card; this allows for a fluid transition into mobile-only behavior. Although mobile technology is widely available, using a contactless card with your mobile wallet can help you scale your payments services towards the “digitally unprivileged” or in areas of the world were public connectivity still lags behind in enabling proper conduct of cashless services using mobile devices.

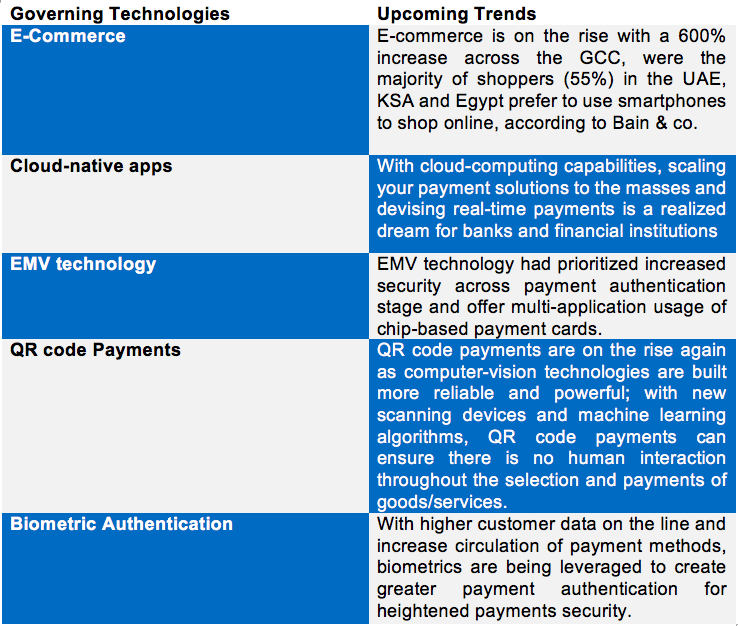

There are many forms of ensuring contactless payments journey for the end consumer, and the technologies governing them vary as well. With IoT and cloud-computing reassuring us of the scalable and reliable nature of modern contactless solutions , we look to divide the share of most used contactless technologies, in terms of consumer preference and security governing the contactless payments solution.

Paying Post Covid-19 world

Merchants, banks, and consumers alike are focusing on a key endeavor, which is keeping Covid-19 away; with the WHO warning against cash usage as it being likely to cross-contaminate, and till 75% of the world population is vaccinated, merchants and financial institutions should keep pushing for greater contactless solutions acquisition that can reduce human interaction and surface-touching. Banks need to look deeper into visualizing a new consumer purchase journey that optimizes queuing time, transaction limits, and device usage; and such payment solutions rely on technologies such as, cloud-computing for device agnosticism and scalability, and IoT for around-the-clock connectivity and interoperability. Contactless technologies can reduce the time it takes to pay by 3X.

Infotec Systems as a trusted payment solutions provider

At Infotec we pursue contactless payment adoption as a long-term plan that can optimize your banking operations and keep you closer to your customers through growing your contactless payments portfolio and keeping you up-to-date with their growing need for contactless payments, our proven expertise and market-place power enables us to support our banking partners across all stages of developing and deploying contactless payments solutions.

No matter the game plan, banks need the right partner to raise their capabilities and ensure the victorious deployment of their contactless technologies to the market.

Infotec keeping your wheels of innovation running!